How to Buy a House (Comprehensive Guide)

Everything you need to know about buying a home in Canada to get you from initial research, to mortgage approval, to an accepted offer.

Buying a house is one of the biggest decisions many people will ever make. Both financially and emotionally there is a lot riding on it, so it is incredibly important that you make smart choices in order to avoid regrets.

The home-buying process is complex and depends on many variables. It’s easy to get ahead of yourself and skip something important which could set you back significantly. This guide is intended to help walk you through the process step-by-step and ensure that you have all the information you need to evaluate and make the right choices along the way.

Whether you’re a first time home buyer or just haven’t done it in a while, following this guide closely should put you well on your way towards home-ownership.

How to Buy a House in 8 Steps

Home-buying is an extensive process and there is a lot to cover. We have tried to organize everything into 8 distinct stages of the journey. Use the anchor links bellow to quickly navigate to different sections of this guide or scroll through it sequentially. You can click the “Table of Contents” links found at the bottom right of each section to navigate back to here.

- How to Buy a House (Comprehensive Guide)

- How to Buy a House in 8 Steps

- Determine if Home-Ownership is Right for You

- Decide Where and What to Buy

- Understand the Financial Requirements to Buy a House

- Equity / Down Payment

- Get Pre-Approved for a Mortgage

- How Mortgage Brokers Help

- Choosing the Right Mortgage

- Search for Potential Houses

- Close the Deal

- More Resources

Determine if Home-Ownership is Right for You

Decide Where and What to Buy

When buying a house, you need a clear picture of what and where you would like to buy in order to avoid settling for a sub-optimal outcome. Having a well-defined, realistic property objective helps you evaluate all potential outcomes against your expectations and determine whether or not to proceed.

In this stage you’ll want to give a lot of thought to how your property objective fits into your broader plans for life and any potential problems that could arise. Make sure to consider how owning a home in a particular location may affect your career, family, mobility, recreation, and retirement goals going forward.

You will also want to be aware of the costs associated with different types of properties – for example condo fees, maintenance, utilities, insurance, and the differences in property taxes in various urban and rural areas. Don’t cause yourself a hidden cost headache down the road.

Understand that different property types and locations have different rules, regulations, and financing requirements that also may impact the feasibility of your goals.

PRO TIP: Talk with a mortgage broker early in the process. A broker is familiar with many different lenders and their lending rules and can help you determine what property objectives are realistic and within your financial reach.

Understand the Financial Requirements to Buy a House

One of the first questions any prospective home-buyer should be asking is “are my home-ownership goals financially feasible?” In other words, can you get a mortgage?

To lend hundreds of thousands of dollars to you, lenders need to ensure that you are financially capable of reliably managing all of your existing financial obligations in addition to your new mortgage and other home-ownership related costs, even in the face of an unforeseen setback such as unemployment.

To assess your financial worthiness, lenders consider three different broad indicators of financial health in context with the property type, value, and location that you are considering.

Although property specific conditions and regulations may vary, lenders are legally obligated to consider your Income, your Credit, and the Equity (down payment) you have available before they decide to lend you any money. You can use the handy acronym I.C.E to remember this. A mortgage professional can help you navigate these requirements.

Income

To qualify for a mortgage in Canada, you have to be able to prove that you reliably earn enough income to cover all of your debts and expenses. This includes all existing debts and expenses such as vehicle loans, credit cards, lines of credit, and student loan payments, as well as your new mortgage, property taxes, and an allowance for expected home heating costs.

What you can afford with the income at your disposal is determined by a maximum ratio of monthly debt payments and expenses to monthly income. When it comes to affordability, there are two ratios that lenders consider.

The Gross Debt Service Ratio (GDSR) is the percentage of your gross (pre-tax) income that is required to pay for housing related costs including the mortgage, property taxes, utilities, and 50% of any condo fees. To qualify for a mortgage, it is recommended that your GDSR does not exceed approximately 35% to 39%. There are some exceptions for situations in which the down payment exceeds 20% of the purchase price.

Mortgage Payments

Property Taxes

Heating

50% of Condo Fees

The Total Debt Service Ratio (TDSR) is the percentage of your gross (pre-tax) income that is required to cover all housing related costs considered in the GDSR plus all of your other debts such as credit cards, vehicle payments, lines of credit, alimony and child support, etc. Except for cases involving large down payments (>20%) your TDSR can not exceed 44%.

Credit Card Payments

Car Payments

Lines of Credit

Student Loans

Any Other Debts

Income requirements vary depending on your employment type (self-employed, probation, guaranteed vs non-guaranteed hours, or contract work) as well as the size of your down payment.

RULE OF THUMB: Generally, the house you can afford will be under 5x your gross taxable household income.

Credit

Before they approve you for a mortgage, mortgage lenders want to see that you have a reliable track record of paying your debts and bills. To do this, lenders will assess your credit history by looking at your credit report.

A credit report is a recorded history of how you meet your financial obligations over time. It records the types of credit you have had, the balances you’ve carried, your payment history, as well as any past involvement with collections, consumer proposals, or bankruptcy.

Your credit information is then mathematically translated into a 3-digit numerical credit score (FICO score) between 300 and 900 using a points and weighting system. Many lenders are looking for a credit score of at least 650 to approve you for a mortgage.

It is recommended that you obtain a copy of your credit report early on in your home-buying process so as to avoid any unfortunate surprises further down the line.

Poor or insufficient credit is a common challenge faced by many prospective home-buyers. Luckily, credit can be fixed or established with some discipline, but it does take time, so better to start sooner rather than later.

The best ways to keep your credit report looking shiny is to:

- monitor your own credit report (Credit Karma)

- pay bills on time as agreed

- keep your credit card balances between zero and 50% of their limits (never max them)

- establish at least 2 forms of credit (credit card, line of credit, small car loan, etc.)

- use any revolving credit that you have (ie. credit card, line of credit) regularly and then pay it off

- only let people check your score if absolutely needed as multiple checks can look bad and lower your score

Different lenders have different credit requirements, so if one says no, that doesn’t mean they all will. A mortgage broker can help you better understand your credit as well as the different lending options available to you in your particular situation.

Equity / Down Payment

Finally, you must have some of your own money “on the table” to get a mortgage in today’s lending environment. This is called your down payment, and – although there are ways to synthesize a zero-down mortgage in special situations – the rule is you need to have your own equity stake (ie. your savings) to get a mortgage. There are various acceptable sources of down payment.

A down payment is defined as the amount of the property’s purchase price that you supply yourself at the time of purchase (ie. your down payment/equity + mortgage loan = property purchase price).

The minimum down payment required to get a mortgage depends on:

- Property type (house, acreage, raw land, new build, etc.)

- Property’s intended use (residential, investment, commercial, farm, etc.)

- Your credit profile

- How you earn your income, and how much of that income shows up on your personal tax returns

- Estimated “closing costs” for your transaction (lawyer, land transfer tax, land title fees, appraisal, inspection, property tax adjustment, other fees, etc.)

- The lender’s specific internal guidelines

Generally, for a good credit, tax-paying Canadian looking to purchase an owner-occupied home in an urban area, the minimum required down payment is:

- 5% of the purchase price plus 1.5% for closing costs for a property worth less than $500,000

- between 5% and 7.5% of the purchase price for a property worth between $500,000 and $999,999 (plus 1.5% for closing costs)

- >20% of the purchase price for properties exceeding $1,000,000

Acreages require larger down payments and raw land / vacant lot purchases generally require much larger down payments.

If you have under 20% down payment, you will also need mortgage default insurance, which is automatically added to the mortgage balance and payment. This type of insurance protects the mortgage lender from loss in the event that you fail to make your mortgage payments. It does not protect you.

For people with exceptional credit and low debt-to-income ratios who simply do not have the required savings to purchase a home, it is possible to borrow some or all of the minimum 5% down payment on a separate line of credit, or personal loan.

It is also possible for a family member to gift some or all of the down payment as long as this is properly documented.

If you are buying your first home, there are certain programs available to you to help make your first purchase a little easier.

Get Pre-Approved for a Mortgage

If you think that you meet the income, credit, and equity requirements to buy a home in Canada, then the next step is to get pre-approved for a mortgage. This will help you determine what you can afford and identify any unforeseen obstacles that you will have to deal with.

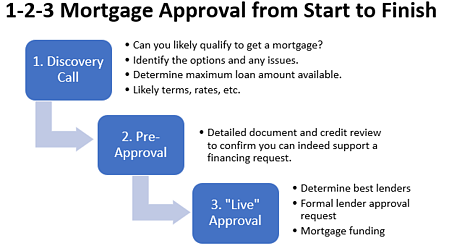

Please understand the difference between a pre-qualification discussion and the much more rigorous pre-approval process.

A pre-qualification is essentially a general statement on what mortgage amount you could likely get based on your stated income and debt load. It assumes you have the required down payment for the property-type you are after and there is no real review of your documents or credit report. Sound confusing? Well it is – there are many variables to lending, and the devil is in the details that can only be uncovered in a more thorough review that is an actual pre-approval.

It is recommended that you get pre-qualified very early on in the process so that you have an idea of any potential issues, qualifying amounts, and to help frame your planning. For example, why dream about a $400,000 home when your income and debt load can only support a much smaller amount? We call this a “Discovery Call.”

A pre-approval is a comprehensive review of a mortgage application, credit report, and all documents that will be used to support your mortgage objective, followed by a written statement confirming that you meet the income, credit, and down payment requirements for a loan of a certain value for a specific property type. There are typically a number of conditions attached and the pre-approval is only temporarily valid.

You should get pre-approved for a mortgage before you begin shopping for a property as that process will confirm you can indeed be approved when the time comes and removes dangerous assumptions about your income, credit or down payment from the process. Sellers and realtors will also take you more seriously. It’s important to note that pre-approval is not a guarantee of a final approval as the property you choose still must meet the conditions of your lender, so always make your offer of purchase conditional on financing.

Although some banks may advertise quick and easy pre-qualification or approval processes, keep in mind this is only for the lending options that they provide and will not provide a full picture of the entire mortgage lending market. They also have limited options to help you if you do not meet their strict requirements. Click here to read about the full mortgage approval process.

How Mortgage Brokers Help

Working with a mortgage broker gives you access to a much broader range of mortgage financing options than working with an individual lending institution. Banks and other mortgage lenders make their mortgage products available to mortgage brokers and compete for your business. Brokers are able to shop among them on your behalf to obtain lending solutions and great deals based on the specifics of your needs and circumstances.

While you might be able to qualify for a mortgage at your usual bank, it is important to understand that the representatives there are acting in the interests of their employer and have no incentives to suggest the mortgage products of other lenders that may have more suitable options. Brokers are able to act as intermediaries between you and the various potential lenders in order to present a range of potential mortgage options.

A mortgage broker does not cost you anything because they get paid a commission by the mortgage lender (not you) only when they successfully fund your mortgage.

The end result is a great rate, more choice and better advice.

If you are unsure whether you meet the requirements for a mortgage, click the get started button to provide us with some initial information and we will let you know if an opportunity exists.

Choosing the Right Mortgage

There are many lenders in Canada and even more lending programs, but not all will apply or be right for you.

A mortgage is a loan for a real estate property, but it is not a one size fits all financial product and there are a number of variables to consider. In addition to the size of the mortgage that you choose/qualify for, you will also need to consider the mortgage rate, amortization period, term, payment frequency, and any potential penalties you could incur down the road. There are also add-ons and special offers to think about depending on your financial situation and what you are trying to achieve.

The mortgage rate is the interest rate that you are expected to pay back to the lender in addition to the initial principal that you borrow. Think of it as the rental rate for money. The mortgage rates available to you depend on a variety of factors including your financial situation, the property type, the contract term, and external economic factors that affect all interest rates. Rates can either be fixed (locked in for the term of your mortgage) or variable (floating rate that is subject to changing economic conditions). The lowest rate does not always mean the lowest cost for your mortgage as there are other considerations such as penalties, portability, and restrictions on your ability to qualify.

The amortization period is the amount of time it will take you to fully pay off your mortgage by following a pre-determined payment schedule. The longest amortization period currently permitted in Canada for mortgages with under 20% down payment is 25 years.

The amortization period is broken down into periods of time known as terms during which the contractual parameters of the mortgage have legal effect. After each term the remaining mortgage balance must be renewed (recalculated at current rates with either the same or a more competitive lender), refinanced (renegotiated with additional funds borrowed), or paid for in full (usually not an option). You keep renewing your mortgage until your house is fully paid off. The most popular term (with the most competitive rates) is 5 years, but it can be as little as 6 months or as much as 10 years.

You will also need to select a payment frequency. This is simply how often you make payments against the balance of your mortgage. Many people will choose to sync up their payment schedule with their paychecks. The more frequently that you make payments, the less you end up spending in interest over the life of your mortgage. This is because you pay off more of the balance in between each time the mortgage is compounded (when interest is calculated and added to the total balance).

If you have less than 20% down payment, you will need mortgage default insurance from a provider such as CMHC or Genworth. This protects lenders (not you) in the event that you cannot or do not make your payments and default on your loan. Mortgage loan insurance is calculated as a percentage of your total loan amount and is typically higher for smaller down payments. It can usually be paid up front or added to your mortgage loan.

Different lenders and lending programs have different penalties included in their contracts that you should be aware of, which can be incurred for numerous reasons such as terminating your mortgage before the end of your mortgage term (this is often the case if you sell the property).

Finally, there are add-ons and special offers such as purchase plus improvements programs (bundle the cost of planned renovations into your mortgage), first time home-buyer assistance programs, and limited time rate offers.

A mortgage broker makes choosing the right mortgage easier because, unlike bank reps, they have access to a much wider range of lending products and are not tied to one line of business. This allows them to make recommendations that are more specific to your personal situation and negotiate on your behalf between lenders to obtain better terms and conditions than would otherwise be available.

Search for Potential Houses

Once you have mortgage pre-approval in hand, you can begin to search for a property that fits with your financial capabilities.

Keep in mind that just because you have been pre-approved for loan of a certain value does not mean you should spend that much on a house. Choosing a property that costs less than the maximum you could afford leaves you a little wiggle room in the event of unexpected changes in interest rates, your expenses, or your ability to earn money.

When searching for a house, it is important to consider not just your current needs, but also how those needs may evolve over the next 5 or 10 years. Consider how a potential property fits into your ongoing career, family, and lifestyle goals. A clear picture of your needs and goals helps you avoid settling for a property that might cause you frustration down the road.

To determine how well a particular property fits your housing needs, there are five property specific considerations.

- Location – Where is the property located? This is not just about what city, town or rural area you choose to buy in, but also about how the property is situated within. What are the nearby transportation, shopping, education, employment, recreation, and healthcare options and how do they compare with your priorities? What are the neighborhood and neighbors like? Also consider any undesirable location attributes of a potential property such as local crime rates and proximity to various forms of noise, pollution, odors and allergens (sellers won’t be motivated to disclose this type of information, so do your research).

- Type – What type of property are you considering? In addition to financing differences for different property types, there are lifestyle differences as well. Are you interested in a house, duplex, condo, townhouse, or an acreage? Do you need a basement? Can you navigate the stairs? Where will the children sleep? Where will the teenagers sleep? Do you need a backyard, and if so what direction should it face? Consider how attributes such as shared walls, storage space, and general maintenance requirements may impact you.

- Size – How much space is required? How many bedrooms, bathrooms and living spaces do you need? Do you plan on having children or pets? How often do you have guests? Do you need a home office? Is outdoor space a priority? These are all questions that you should ask yourself when determining how big of a property to buy. Keep in mind that bigger properties require more upkeep and cost a lot more.

- Features – What type of special features do you value in a home? Think about which features you would like such as a garage, big backyard, air conditioner, central-vac, in-floor heating, walk-in closet or a hot tub. Also consider eco-friendly options such as solar panels and energy efficient heating, plumbing and insulation.

- Expenses – What kind of ongoing expenses can you expect? The initial purchase of a property is just the beginning of the costs of home-ownership. Property taxes, utilities, condo/HOA fees, potential renovations, and general maintenance (especially for older homes) are all expenses that should be researched and understood before you purchase a home. The larger and/or older a property is, the more expenses you can expect.

Be sure to take the time to do your research and don’t allow yourself to rush or feel pressured into any hasty decisions. The choices you make today will impact your lifestyle and finances for years to come. Having the right Realtor on your side can help you assess your options and ensure you get a property that is right for you.

How Realtors Help

Like a mortgage broker, a Realtor can be an invaluable source of information and guidance during the home-buying process. Realtors should be an expert in the communities in which they operate and in their local real estate markets. Not only can they help find the right property for you, but they can also help you negotiate the best deal and navigate regional and situational complexities using their local knowledge.

Real estate markets go up and down all the time. Realtors have access to past and comparable sales data and understand the market history and trends which can help you identify a good time to buy and determine how much you should be willing to pay.

Realtors are also helpful when it comes to submitting offers and managing paperwork, contracts, and title transfer complexities. In addition to keeping track of everything and ensuring you don’t miss something important, they also help you to save a considerable amount of time over the course of the home-buying process.

How to Choose a Realtor

When it comes to choosing a Realtor, trust is key. You need to make sure that the person representing you through one of the biggest decisions of your life is somebody who you can rely on to provide dependable advice and expertise. Ask for recommendations from friends and relatives or look at listings in the areas you are considering to identify industry leaders. Feel free to conduct interviews to find one that you feel comfortable working with.

Realtors tend to specialize in different areas of the real estate market, so it is important to know where and what you are looking for before you begin working with one.

Understand that Realtors are held accountable by a code of conduct that ensures that they represent you to the fullest of their abilities without conflict of interest and insures you against negligence or incompetence on the part of the agent.

To avoid conflict of interest, we suggest you avoid calling the Realtor whose name is on the listing you are interested in if you are looking for someone to represent you. Ask yourself, how can that person represent both your best interests (get you the lowest price for example) and the seller’s best interest (get them the highest price)?

You will likely need to sign an Agency Service Agreement which gives the Realtor the right to represent you for a certain period of time. Some agreements are better than others so get to know your Realtor a bit and make sure you trust and can work with them before you agree to sign anything.

Remember that like mortgage brokers, most Realtors are paid a commission only when the deal is finalized, so use their time and services only if you intend to follow-through with a purchase (ie. be loyal to those that help you).

Make an Offer to Purchase

Once you have found a property that meets your requirements and is within your price range, it is time to make an offer.

Your Realtor’s job is to help you make an offer. Using past comparable sales data and their knowledge of market trends they can help you identify good value for your money and determine what you should be willing to offer. This allows you to move quickly on well-priced properties that meet your criteria.

Even with professional representation, it is still important to do your own research as well. You should have a broad view of what similar properties are listed for and – more importantly – insight into what similar properties are actually selling for. While it can be emotional, it’s best to be armed with facts and knowledge to make the decision more rational and mechanical. And remember, if one door closes (deal not quite right), another door will open!

Components of an offer to purchase

If you are working with a Realtor, they will handle the specifics of submitting an offer to purchase, but it is still a good idea to have a basic idea of what an offer looks like.

An offer to purchase, if accepted, is a legally binding contract between the buyer and the seller that establishes the parameters of the transaction. It includes the legal names of the parties involved in the transaction, a description of the property, included unattached goods (chattels) such as appliances or furniture, excluded attached goods (fixtures), financial details of the transaction, all conditions, stipulations and deadlines, and the closing date; whereupon you get the keys.

Don’t be afraid to negotiate. While it can be uncomfortable for some, this is a big purchase and it is all about finding the optimal middle ground between you and the seller. The seller may be way more motivated to sell than you are to buy their particular property vs. others on the market. That could mean a great deal for you if you have done your homework on pricing.

Condition of Financing

When you are ready to submit an offer of purchase, it is important that you include a condition of finance (COF) deadline which indicates a date by which you will have your mortgage financing secured and finalized. This is a deadline that you get to choose. If you make the deadline too fast and are unable to arrange your financing in time, you could lose the deal if another buyer comes along.

Assuming that you have already been pre-approved for a mortgage (full review of income, credit and down payment including document review), you can set a slightly tighter financing deadline, but remember that the specific property that you choose still must meet the conditions of your specific lender to finalize your mortgage approval. An unrealistic deadline puts a lot of pressure on you and the system in general, especially during busy times.

Generally, we recommend that you (via your Realtor) set the Condition of Finance or COF date to 10 business days after the seller has accepted the offer, rather than choosing a specific date. That way if negotiations drag on, the COF is not inadvertently compressed.

For an insured mortgage on an urban house with Realtors involved and your pre-approval in hand, financing can usually be arranged within 5-7 business days. Where a physical appraisal is required (non-insured mortgage) 7+ business days, and for remote properties with outbuildings, potential condition issues, or for private transactions allow for at least 10-14 business days. More time is always better for you, so don’t let yourself be pressured into a short deadline! Also keep in mind that the lenders with the lowest interest rates are the busiest, so they too need more time.

You may also want to make your offer subject to additional conditions such as a home inspection or satisfactory review of condo documents (if buying a condo). These conditions also must be satisfied within the specified time frame.

Deposits

When your offer is accepted by the seller, you will need to make an immediate deposit of funds to secure the property. This is “good faith money” to verify your buying intent and will be credited toward your down payment when you purchase.

Never give your deposit directly to the seller. Instead, the deposit check should be made out “in trust” to the seller’s real estate agent’s brokerage office or to a lawyer until all conditions of the offer to purchase have been satisfied. If one or more of the purchase conditions are not satisfied, then the money is returned to you. However, if the conditions are all satisfied and accepted and then you cannot complete the deal for whatever reason, you will likely lose your deposit.

A deposit of 1-2% of the purchase price is typically enough, but sometimes more is required. Once the deal is finalized, the deposit is credited as part of the down payment.

Property Inspection

It is becoming increasingly common for home-buyers to make their offer to purchase conditional on home inspection. Sellers don’t have a motivation to disclose any potential issues or concerns with the condition, safety, structure, or functionality of the property and not all defects are easily apparent.

The purpose of a home inspection is to uncover any potential defects in the property, its systems, its components, and the surrounding land before getting locked into a contract to purchase.

It is of paramount importance that the home inspector you choose is trustworthy, experienced, and reliable. Do your research on how to choose a home inspector and find one with a reputable track record and specific home inspection experience and training. The goal is to be completely confident that there are no unexpected issues with electrical, plumbing, heating, roofing, foundation, structure, interior and exterior.

Avoid price shopping as cutting costs on a home inspector could cost you thousands if they miss something. The good ones might cost a little more!

Review Condo Documents

If you are buying a condo, you should also make your offer subject to a satisfactory review of the condo documents. You will want to obtain copies of the condominium reserve fund study, its financial statements, and the latest annual general meeting minutes from the condo board. What you are looking for is any indication of poor financial management on the part of the governing body of the condo corporation and any mention of a “special assessment” (a levy imposed by the condo board on condo owners in excess of their normal condo fees to account for an unexpected shortfall in the budget). Ask your Realtor if they can recommend a Condominium Document Review specialist if you are not sure what you are looking for.

Finalize Your Mortgage Approval

Once the seller has accepted your offer and conditions, your mortgage professional will work with you to finalize your mortgage approval prior to your Condition of Financing deadline. Provided that your mortgage pre-approval was conducted competently and the property you have chosen meets all of the lender’s requirements, there shouldn’t be any surprises at this stage. (Meanwhile, you and your Realtor will be working on the other purchase conditions, such as the property inspection).

Lender Underwriting (takes 1 - 7 days from a formal submission)

Your mortgage professional will require a copy of the accepted Offer to Purchase and an MLS Listing Sheet containing the property details, which your Realtor can provide. Your electronic application is updated with the property details and financing deadline.

Your mortgage broker will review their list of preferred lenders and identify a target lender with the best rate and terms for your situation. Your property details and loan application are then submitted to that lender via Filogix Express™ and queued electronically. Normal queue time for underwriting is 24-48 hours. Sometimes during the busy spring season, there is a longer wait time in the queue (48-72+ hours) before an underwriter reviews your application (this can slow an approval).

For a mortgage broker, a fast lender queue is definitely a factor in choosing who to submit to, but sometimes available rates and terms justify the wait (the best lenders are typically the busiest!).

Mortgage underwriting is the process a lender uses to determine if the risk of lending to a particular borrower under certain parameters is acceptable. Think of an application like a chair with 4 legs which represent your income, credit, down payment, and the property itself. In order for your application to successfully support a loan all 4 legs should be proportional and stable. If one leg is a bit weaker than the others, the application still might stand, but with multiple weak legs, the application collapses. A thorough pre-approval should prevent any surprises at this stage and will determine which lenders are suitable to submit to.

If a lender declines to provide a mortgage commitment or is taking too long and you are working with a mortgage broker, they can re-submit for approval to the next best lender.

Conditional Commitment Processing (takes 2 - 4 days from lender approval)

If your application meets the lender’s underwriting guidelines, your mortgage professional will produce an electronic “commitment” signifying that your application has been approved subject to a list of lending conditions that you would still need to satisfy. The conditions will stipulate what documents are required to prove income, assets, employment, property details and value (for example, an acceptable appraisal, discussed below). If the loan terms are acceptable to you, you accept their offer (sign the commitment) and set about to meet the applicable lending conditions.

Generally, the majority of the loan conditions will be satisfied by documents that you have already collected and are sitting in your mortgage professional’s file if indeed you were properly pre-approved for a mortgage (application, credit review and document review). You may need to update your file with a more recent pay stub, or an update on your down payment savings if the file copies are too old. Having done a pre-approval with document review in advance really speeds up the process and avoids nasty surprises, therefore you should make sure this step happens early on.

There is usually a document review queue at the lender’s end, so the faster you can get the accepted commitment and 100% of the required support documents to the lender, the faster you can get to “file complete,” whereby all “broker” conditions have been met and accepted by the lender.

The lender then triggers “mortgage instructions” to be sent to your selected lawyer. At this point, your mortgage professional will advise you, your Realtor (if applicable) and your lawyer, in writing that funding has been “approved.” If there is a financing condition on an Offer to Purchase, your Realtor can now lift that condition.

Property Valuation

As mentioned above, before any mortgage is finalized, your mortgage lender will require a property valuation or appraisal in some form. This is to ensure that the money they are lending you, plus your down payment, do not exceed the fair market value for the property as determined by a licensed appraiser.

Appraisals are conducted by licensed appraisers who determine what the property is worth based on comparable sales data for the area. This is different from a Realtor’s comparative market analysis and is also not the same thing as a home inspection.

Typically, lenders will require that the appraisal is conducted by an appraiser that is on their specific “approved list” and will have instructions on what can be included and what cannot in the valuation of the property. For example, most residential lenders will not attribute any value to outbuildings such as barns, shops, and sheds.

An appraiser may or may not physically visit the property, as there are electronic methods as well; it depends on the lending situation. Site visits will certainly be required for private purchase transactions, refinances, mortgages that will not be CMHC-insured, acreages, foreclosures, any MLS listing where property condition issues are noted, and often when the purchase price is reduced after the offer was accepted/home inspection.

Your mortgage professional will order and coordinate the appraisal.

Close the Deal

After the condition of financing and any other contractual stipulations have been met and conditions lifted, the deal is “ready to close” and the mortgage professional, your Realtor, the mortgage lender and your lawyer begin to coordinate the last phase of your purchase transaction, called Conveyancing and Funding.

Congratulations on getting this far. You have almost bought your first home! Pour yourself a drink of your choice and celebrate the milestone! The work isn’t over yet however, as there is still lots to do before you are comfortably moved in. You will need to arrange utilities contracts, get property insurance, do some banking and meet with the lawyer.

What to Expect with the Lawyer

Coming up, you will – in most cases – be meeting with your lawyer or notary to conclude or “close” your transaction. Here’s what to expect next:

- Once your loan is approved, your Lender sends a package of papers called “mortgage instructions” to the lawyer you have designated. These instructions outline the lender’s requirements before they will advance the mortgage money. Think of this as the lawyer’s “to-do list.”

- For purchase transactions, the lawyer will also need a copy of the Offer to Purchase, plus all schedules and waivers to that agreement. Normally, your Realtor provides this to your lawyer, or if a private transaction, you’ve likely already been in contact with your lawyer.

- The lawyer matches the mortgage and purchase contract paperwork, and after some preliminary work on your file, they set an appointment with you to come in and sign a series of papers. They will also tell you to bring a certified check or bank draft for a specific amount to cover the balance of your down payment, legal costs, applicable taxes*, and any required adjustments. If you haven’t done so already, move all of your down payment funds into a single checking account You will also be asked to bring proof of fire insurance, a VOID check, government photo identification, and one other form of identification. Everyone on the mortgage approval must attend the meeting.

- Once the lawyer meets with you and all the papers are signed and after the last of their to-do list is complete, your transaction becomes “ready to fund.” On the closing date, the lawyer requests funds from the Lender (typically around 10 am), then pays everyone that needs paying (by noon) and registers you as the new owner. You are now ready to pick up the keys!

Utilities

There is often confusion around what to do about utilities when moving. Before you move you will want to contact your current service providers for power, gas, cable, telephone and internet and inquire as to whether they operate in the area you are moving to. If they do you will likely be able to transfer any existing contracts to your new residence. Otherwise you will have to cancel existing contracts (hopefully without paying a penalty) and arrange new ones to be in place for when you move into your new home.

Make sure that when you cancel or update your contracts that you record the date, time and name of the person you talked to. It can happen that something gets inputted into a system wrong and you want to be able to prove that it was not your fault and that you did everything right. A forgotten or improperly canceled contract could show up as a negative on your credit report, not to mention be a pain to correct.

These days, many provinces allow you to purchase natural gas and power from independent “energy retailers” and it can be confusing. First you need to figure out which pipeline or electrical company services the area (ask the town or city office), then what are the energy supply options. My general advice is simply ask for the “default / regulated supply option.” Here is a blog I wrote on the topic.

Insurance

Property insurance

As part of the conditions of funding, your mortgage lender will require you to have property/fire insurance, which is to protect you (and the lender) against financial loss from damages to your property due to an unforeseen event such as a fire or flood. Imagine losing your house to a fire while still owing a significant portion of your mortgage loan – that could be catastrophic! Start with the insurance company where you have your tenant or vehicle insurance and go from there. Your lawyer will be asking you to bring in an “insurance binder letter” to the upcoming pre-closing meeting.

Life and disability insurance

While you are not obligated to have life and/or disability insurance, it’s strongly recommended that you review your needs at this point in time. These protect you and your family from losing the home in the event there is a loss of income (death or disability) and still a mortgage to pay.

There are two types of life and disability insurance to consider. Mortgage life insurance is easy to get and the payout is tied to your mortgage balance which diminishes as you pay it off. Term life insurance is an independent life insurance policy which may have more requirements to qualify for, but the payout is independent of your remaining mortgage balance. Sometimes it’s easiest to sign up for mortgage life insurance at the time of mortgage approval and then cancel it if or when you are able to find a better term life policy. Insurance Brokers are like mortgage brokers; they can shop the market for you. Banks often have their own insurance divisions. Here is a link to read more on life insurance.

Note: CMHC mortgage default insurance has nothing to do with the items above. If you are still confused, ask your mortgage professional or lawyer and they will be able to explain any questions that you might have.

Land Transfer Taxes and Title Transfer Fees

Depending on where in Canada you are buying, you may need to pay a land transfer tax as part of your closing costs. This can be a big additional expense. Tax rates vary from province to province and in some cases from municipality to municipality. Neither Alberta nor Saskatchewan have land transfer taxes. Some provinces such as Ontario and British Columbia offer first-time-buyer land transfer tax exemptions to help make it easier to purchase your first home. Ask your Realtor about this tax when you first meet.

Moving Checklist

There are several things you can do to make moving into your new home easier. Starting early and keeping organized rather than leaving everything to the last minute is probably the number one thing that you can do to make your move easier. Make a list of everything that you will need to accomplish and organize it into different time horizons.

One month before your move

- Start selling what you don’t need! Use sites like Kijiji, Ebay, and Facebook Marketplace.

- Clean out your closets, basement and garage. Donate unused items to your favorite charity or have a garage sale to help pay for some of your move. (Can’t decide whether to sell it or move it? Consider how much you could sell it for versus what it will cost to ship it.)

- Get packing supplies; tape, boxes, tissue paper, bubble wrap, markers.

- If this is a big move, start packing items of limited use prior to your move. Pack up things like photo albums, books, and seasonal decorations.

- If you’re packing items that will go in storage, make an itemized list of each box and its contents.

- Start a log of moving expenses and keep all your move-related receipts. Some items may be tax deductible.

- Find a reputable mover. If you’re hiring professional movers get written estimates from at least two moving companies; include their written commitment of pickup and delivery dates. Ask for and check references. Check the limits of insurance they offer and whether or not it covers replacement costs. Purchase additional insurance if you need it.

- DIY movers be aware that while you can book a U-Haul well in advance, they don’t guarantee there will be a truck for you, only that they’ll do their best. If you can move mid-week and avoid month-ends, you should be okay.

- If you don’t intend to clean your home or carpets yourself, arrange for cleaning services now as they get booked up.

- Advise regular tradespeople (gardener, house cleaner, nanny, etc.) if you’re moving out of their service area. Look into service providers for your new home.

- If you are currently renting, make sure to give your landlord in writing the required notice to vacate (typically a full calendar month).

- If you own rental properties, make sure to give your tenants a Notice of Landlord with your new street address (this is a legal requirement)

Two weeks before your move

- Arrange for disconnection or transfer of your utilities (power, gas, cable, telephone, internet, security company). Get back any security deposits.

- Set up mail forwarding with the post office. A one-year term will ensure that annual items will reach you, like T4s, tax papers, or outstanding bills (from the utility companies who couldn’t get it right!).

- Arrange to transfer or close your bank accounts. Order cheques with your new address and phone number.

Empty out your safety deposit box. - Stop or transfer newspaper and other home deliveries.

- Advise friends, family and professionals of your new address and phone number. (Don’t forget your doctor, dentist, chiropractor, and other medical professionals, schools, library, accountant, financial adviser, credit card companies, mortgage provider, Canada Revenue Agency [Revenue Canada], Motor Vehicle Branch, frequent flyer plans, your employer, medical plan, magazine and other subscriptions.)

- Obtain/transfer all doctor, dental, veterinary records including prescriptions, X-rays, records, etc. Make sure you have adequate medications on hand for your family and pets.

One week before your move

- Clean your home or confirm cleaning services.

- Confirm delivery address, phone number and delivery date with the movers.

- Clean out and defrost the freezer. Eat up all that food!

- If you’re moving to another city, pick up dry cleaning, prescriptions, photos, repair items, or anything else left outside your home.

- Collect any spare keys from neighbors, cleaners, family members, etc.

- Clean out school or gym lockers.

- Return library books and any other borrowed items.

- Contact ALL your utility companies and anyone who sends you a bill and give them your new address. Make sure to pay off any amounts owing. Record the names of who you talk to, and date and time, as these companies invariably screw something up, which then becomes your fault, not theirs.

A few days before your move

- Complete packing all household goods for the move. Make sure boxes are clearly marked with the room they will go in, as well as “Fragile” if necessary.

- Keep things you will need like your phone charger handy.

- Place important documents in a safe box that you will carry. Include home purchase/sale papers, will, financial records, passports, birth certificates. Mark “Do Not Move” on the box; move this box yourself.

- Prepare an “open first” box with towels, bedding, basic kitchen and bathroom supplies, toys or games for your children, tools (hammer, screwdriver) to set up furniture.

- Set aside some cleaning supplies for final clean up of your old house and light cleaning for your new house

- Label all keys for new occupants

- Place all appliance manuals and warranties, etc in one place for the new occupants.

Move day!

- Keep your cell phone handy in case you need to contact your movers, etc.

- Make a note of all utility meter readings.

- Carefully supervise the move. Make sure your instructions are understood, and that boxes are delivered to the right rooms.

- Check all the rooms, closets, drawers, and cupboards to make sure you haven’t left anything behind.

- Turn down the thermostat.

- Lock up and leave labeled keys and garage door openers with the landlord, new owners or real estate agent.

- Arrive at your new home before the movers. Show the movers where to put boxes and furniture.

- Check that you’ve been given the keys to every lock in your new home.

- Carefully review the movers’ bill of lading before signing.

- Check for damaged items.

- At your new home, make sure the utilities are on and working properly.

- Unpack your “open first” box. Set up your bed; unpack the kitchen and bathroom to help you feel at home.

- Relax, order in dinner, and take a long hot bath.

After your move

- Unpack, then donate or flatten and recycle boxes.

- Change the address on your driver’s license and car insurance.

- Arrange Out-of-Province inspection of your car if applicable.

- Install carbon monoxide detectors and a fire extinguisher.

- Hide a spare key.

- Plan your housewarming party!

- Recommend your mortgage broker and

- Realtor to all your friends!

Enjoy Your Home

Congratulations on buying your first home (and for making it to the bottom of this ridiculously long page). We hope this guide has been of value to you. If we missed anything or there is anything else you’d like to know, please let us know and we will be happy to address it for you.

If you would like to have us on your home-buying team, we would be happy to set you up with a free consultation to discuss the specifics of your situation.

How to Buy a House (Summarized)

- Determine if home ownership is right for you

- Decide where and what you’d like to buy

- Assess the financial feasibility of your property objective

- Get pre-approved for a mortgage

- Search for potential houses

- Make an offer to purchase

- Finalize your mortgage approval

- Close the deal

More Resources

Buying a Residential Property in Canada

- First Time Homebuying Process – steps for preapproval, then steps to buy

- Free Guide – Homebuying Step by Step

- Free Guide – Newcomers to Canada

- Free Guide – Condominium Buyer’s Guide

- CMHC Housing Outlook – what are the experts saying about housing prices

- Blog for Home Buyers – Richards Mortgage

- Group – subscribe, learn, stay in-touch

- Using Your RRSP for Down Payment – learn the rules

Financing Your Home Purchase

- Mortgage Broker vs Bank – who will help you more?

- Can You Get a Mortgage? – learn what it takes to quailfy

- Setup a Pre-Approval Meeting – ready to get started?

- Mortgage Rates – rate isn’t everything, but it is important.

- Mortgage Approval Process

- Free Guide – 3 Steps to Successful

- Mortgage Shopping

- Mortgage Calculators – ready for some math (or call us!)

- Apply Now – start a mortgage application

- Rent-to-Own for Buyers – another way to finance, when banks say no

- Rent-to-Own for Sellers – another way to sell your home

- Vendor Financing – other way to finance, when banks say no

- Buyer Assistance Programs

- Gift Letter Template – your family can help with down payment

- Qualifying for a Mortgage – what lenders look at

- Mortgage Default Insurance – what is it?

- Mortgage FAQs

Re-Financing Your Home

- Free Guide -Renewing & Renegotiating Your Mortgage

- Free Guide -Borrowing On Home Equity

- Free Guide -Pay Off Your Mortgage Faster

- Renew vs Refinance – what’s the difference?

- Free 15 minute Renewal Consultation

- Reverse Mortgages – seniors can tap into home equity without moving or making payments

- Financing Home Improvements

Understanding Credit

- Free Guide – Understanding Your Credit Score

- Credit Score Improvement Program

- Secured Credit Cards

Mortgages in General

- Mortgage Rates

- Calculators

- Glossary

- Mortgage FAQs

- For Nerds!

Insurance

- Mortgage Default Insurance

- Mortgage Life Insurance

- Life Insurnace Check-up

- Property / Fire Insurance

- Disability Insurance

- Work Disruption

- Title Insurance