7 Step Mortgage Approval Process

An overview of the steps to a mortgage approval in Canada.

A clear understanding of the mortgage application and approval process can help you move forward and make decisions with confidence.

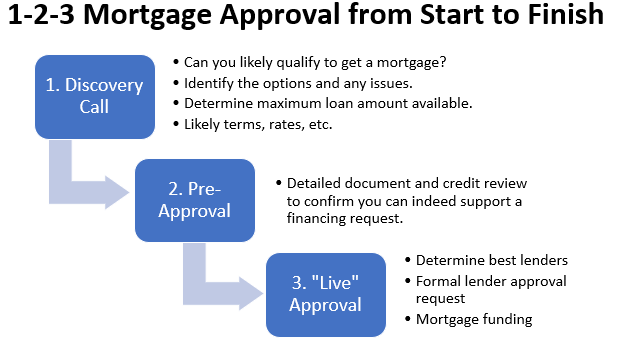

The process of successfully obtaining mortgage financing can be broken down into 7 steps which we divide into 3 distinct stages. The first stage is to have an initial assessment discussion with a trusted mortgage broker to “diagnose” your situation and determine the best course of action. The second stage is the pre-approval in which a formal application with supporting documents is submitted and reviewed. Finally, in the approval stage, financing is formally requested and the details of the mortgage contract are finalized.

Initial Discussion / Discovery Call

Initial Discussion / Discovery Call (step 1) We discuss your financial situation, the loan amount you can likely qualify for, and advise you of any hurdles you may encounter in advance of borrowing so that you will be successful when the time comes. This step helps you clarify your situation and sets you up with an action plan and the confidence to move forward.

Pre-Approval

Pre-Approval – (steps 2-3) We review your mortgage application, check your credit report, actually request and examine your support documents, and then confirm the best lenders for your situation. Our goal is to have potential lenders in mind and standing by (including a rate lock if desired) BEFORE you make any final decisions or purchase commitments. This stage should confirm the information revealed in the Discovery Call.

Approval

Approval – (steps 4-7) We submit your completed mortgage application with support documents, as well as your target property details to the lender that is the best fit for your situation and work with you and them to meet the conditions of financing. Upon a lender’s final approval, the mortgage contract is finalized with your lawyer and funds are transferred.

Each step is explained individually below.

The Mortgage Approval Process in Detail

Initial Discussion

In this stage we get to know you as an applicant and determine the best course of actions to achieve your property and financial goals.

Step 1) Discovery Call (15 minute conversation)

This is a complimentary 10 to 15 minute phone conversation during which we discuss your loan and property objectives, borrowing capacity, and the appropriate next steps as it pertains to your situation. If you are looking for confidence, this is the correct first step. The goal is to quickly determine whether you can meet the requirements to qualify for a mortgage, how much money you can borrow, and whether you are ready to proceed with a formal application. We can even share our screen with you to go through some what-if calculations and scenarios.

After the call, we will email you a summary of our discussion and outline the best course of action to proceed.

To get started, fill out our “Let’s Talk Questionnaire” to provide some initial information, or you can start a conversation with us using the chat bubble that appears on most of our website pages. You can also call us any time at 1.888.540.1715.

Pre-Approval

In this stage we review your application, support documents, and credit reports to insure that they will successfully support a mortgage approval. We also determine the best lenders for your needs.

Step 2) Request Application (1-2 Days)

If it sounds like you could likely meet the requirements to qualify for a mortgage and would like to proceed with an application, we will email you a Mortgage Application Document, Privacy Consent Form, and a personalized Support Document Checklist as part of our Let’s Get Started package, which will guide you through the application.

The necessary documents in the support document checklist are crucial to the application so take your time and make sure that you provide all the documents requested. It will take you time to locate, compile and electronically submit the documents to us, but once you are done, that is the heavy-lifting on your part.

TIP – see scanning documents for your mortgage broker

Step 3) Pre-Approval (1 day or more, depends on you)

Upon receipt of your completed application and privacy consent, we open a file to store and organize the documents you are beginning to send. Your application information goes into an electronic loan processing system called Filogix Express™ used by over 50 mortgage lenders in Canada. We augment your information by pulling your credit bureau report and confirming your debt profile.

With the file open, we wait for you to provide the mortgage support documents per the initial checklist.

As your file documentation comes together, we begin to further review your application and determine which of the lenders are the best fit with respect to rate, contract terms, and customer service for your situation. Our lenders are in constant contact with our office providing their latest in mortgage products, rates, terms and special deals. We also try to determine the lender’s time-line for approval, as backlogs do occur.

Generally, we try to have several lenders in mind that we know will approve your file and advise you at this point that your file has been pre-approved (recommended for approval). This is a temporary conditional commitment for a certain amount of funding at a certain rate, provided that nothing changes in your financial situation.

A pre-approval provides the confidence and context to take action knowing that there is likely a financial solution for your objective. It will also uncover any constraints you might face and we can suggest ways to deal with them.

To “go live” for an Approval, we require a target property evidenced by an Offer to Purchase or property details and a mortgage statement for a refinance. In the case of a purchase, the process will pause here while you shortlist properties and negotiate an offer.

Approval

Step 4) Lender Underwriting (takes lender 1 - 7 days from our formal submission)

Once you have a property and we are ready to “go live”, we update your electronic application with the property details and financing deadline and once again review the file with preferred lenders. A target lender is identified as having the best rate and terms for your situation. We then submit your loan application and property details to that lender via Filogix Express™ and it enters their electronic queue.

Normal queue time for underwriting is 24-48 hours. Sometimes during the busy spring season, there is a longer wait time in the queue (48-72+ hours) before an underwriter reviews your application which can slow an approval. A fast lender queue is definitely a factor in choosing who to submit to, but sometimes available rates and terms justify the wait. The best lenders are typically the busiest!

Mortgage underwriting is the process lenders use to determine whether the risk of lending to a particular borrower is acceptable. To assess the risk of lending to you, lenders will evaluate your application against their qualification guidelines. The 4 key factors that lenders take into consideration are your income (your ability to afford all of your monthly financial obligations plus the new mortgage), your credit (your reputation of how well you manage the financial obligations you take on), your down payment savings or equity (how much of your own resources you will invest in the deal), and the property being mortgaged (what is the condition and characteristics of the property being used as collateral).

Think of these 4 factors as the legs of a chair that has to support your application. If one of the legs is a bit weak the application still might stand, but multiple weak legs and the application can no longer be supported.

If a lender declines to provide a commitment or is taking too long, we can re-submit to the next best lender.

Step 5) Conditional Commitment Processing (takes 2 - 4 days from lender approval)

If your application meets the lender’s underwriting guidelines, we will receive an electronic “commitment” signifying that your application has been approved subject to a list of conditions. The conditions will stipulate which documents are required to prove income, assets, employment, property details and value (for example, an acceptable appraisal). We will call you to discuss the terms of their offer. If acceptable to you, you accept their offer (sign the commitment) and we set about to meet the applicable conditions.

Generally, most of the loan conditions will be satisfied by documents that we already have on file. There is usually a document review queue at the lender’s end, so the faster we can get the accepted commitment and 100% of the required support documents submitted to the lender, the faster we can get to “file complete,” whereby all your financing conditions have been met and accepted by the lender.

The lender then triggers “mortgage instructions” to be sent to your selected lawyer. At this point, we will advise you, your Realtor (if applicable), and your lawyer in writing that funding has been “approved.” If there is a financing condition on an Offer to Purchase, your Realtor can now lift that condition.

Step 6) Pre-Closing (takes 7 - 10 days from 'file complete')

At this point, your lawyer will work with the lender to prepare and register the mortgage with the Land Titles Office and in the case of a purchase, to transfer the title of the property to you. If applicable, you or your Realtor will need to provide your lawyer with a fully executed Offer to Purchase.

You will need to set up an appointment to meet with your lawyer to sign papers, provide your down payment and closing costs, confirm adequate home fire insurance, and satisfy any remaining “solicitor conditions” (for example, to prove you paid off a debt that you said you would pay off).

During this phase it is imperative that nothing changes in your employment, financial, or credit situation as the lender could still back out.

Step 7) Closing (typically by noon on the funding/possession date)

On the funding date, the lender transfers the funds to the lawyer’s trust account and the lawyer then distributes the money to those who are supposed to get it.

In the case of a purchase, the Realtor will provide you with the keys and the lawyer will register your name on title! The loan is now closed.

The 7 Step Mortgage Approval Process Summary

- Initial Discussion

- Request Application

- Pre-Approval

- Lender Underwriting

- Conditional Commitment

- Pre-Closing

- Closing

Communication is Key to a Smooth Mortgage Approval

As we proceed through this sequence, our office provides automated-email progress updates to you, your Realtor, and to your lawyer, keeping everyone informed. In a mortgage transaction there are often multiple balls in the air at the same time and effective communication ensures that no balls get dropped. Please read and fulfill all requests carefully to avoid having to repeat steps. Cooperation and communication ensure a smooth, stress-free and quick mortgage approval process. If you have any questions or uncertainties, we are never more than a phone call away.

Why Choose the Richards Mortgage Group?

Our goal is to provide you with the support that you need to achieve your goals!

At Richards Mortgage Group we believe that knowledge is power and that an informed client is an empowered one. That’s why we keep communication, education, and accessibility as the pillars of our brand. Our mortgage approval process is best suited to clients with a busy, on the go lifestyle who value accurate and efficient advice and service, the convenience of technology, and the personal touch of a family-run business.